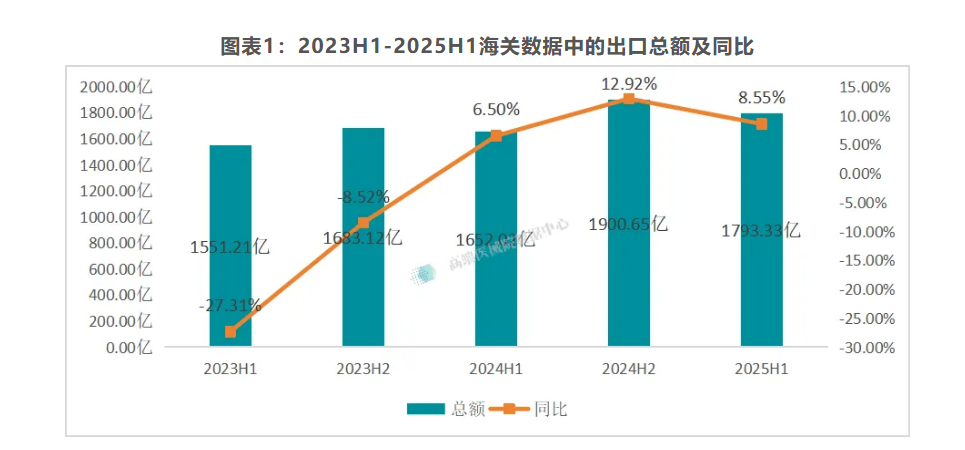

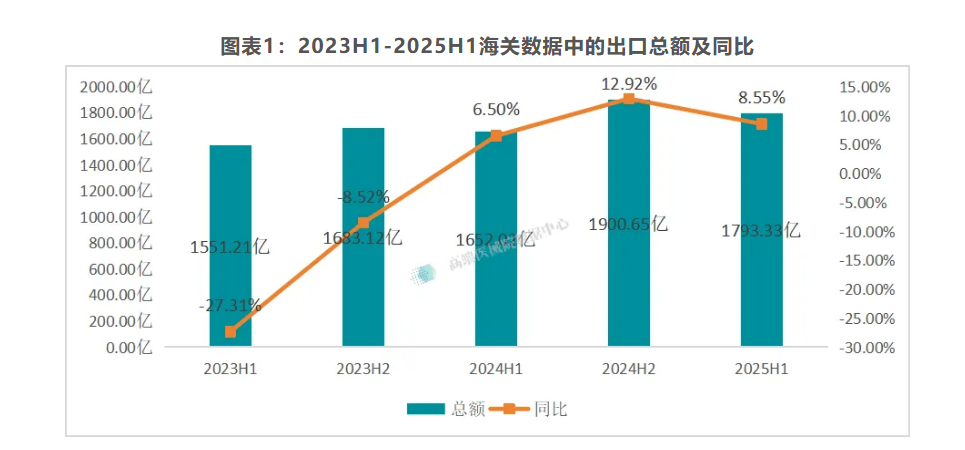

China's medical device exports continued their growth trajectory in the first half of 2025, manifesting strong resilience and vitality. According to statistics from the Data Center of the Guangdong Institute of Advanced Biomaterials and Medical Devices, China's total exports of medical devices reached RMB 179.333 billion in the first half of 2025, up 8.55% year-on-year. From a historical data perspective, this achievement not only represents a significant improvement over the same periods in 2023 and 2024 but also marks a breakthrough amid the complex environment of the China-U.S. tariff dispute, laying a solid foundation for full-year export performance.

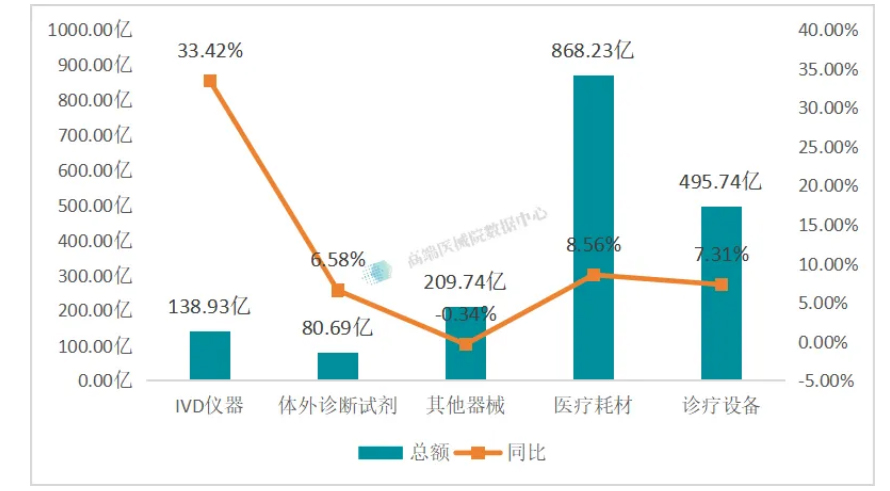

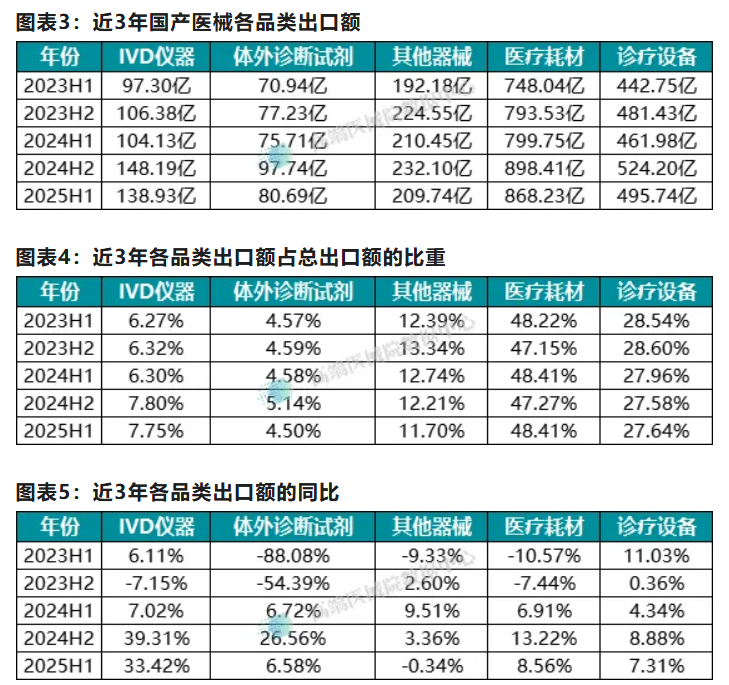

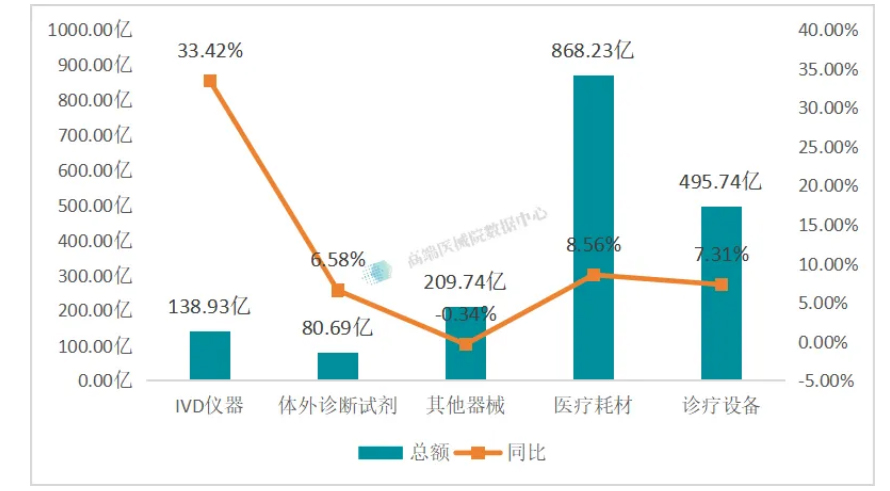

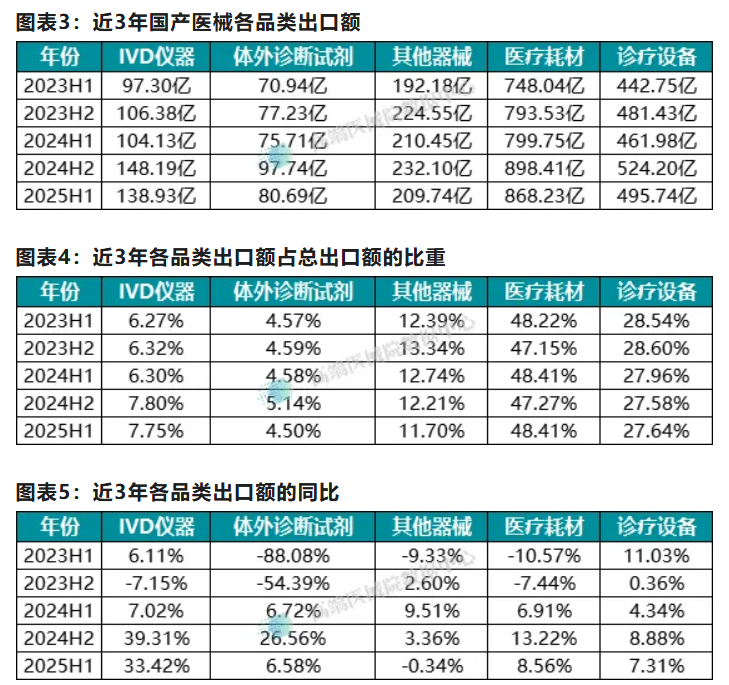

According to the chart data, the category with the highest total exports in H1 2025 was medical consumables, while the category with the highest year-on-year growth was IVD instruments.

Medical consumables: Retained the top position with export value of RMB 86.823 billion, accounting for 48.41% of total exports. The proportion has remained stable between 47% and 49% over the past three years, making it the core category of China's medical device exports. From a growth trend perspective, their export value has continued to rise from RMB 74.804 billion in the first half of 2023, exhibiting steady growth resilience.

Diagnostic and treatment equipment: Recorded an export value of RMB 49.574 billion, accounting for 27.64%, and ranked second, with consistent year-on-year growth, serving as an important supporting category for exports.

IVD instruments: Became one of the fastest-growing categories, with export value increasing from RMB 9.730 billion in the first half of 2023 to RMB 13.893 billion in the first half of 2025, with the proportion in total exports rising from 6.27% to 7.75%. Notably, in the second half of 2024 and the first half of 2025, year-on-year growth rates reached 39.31% and 33.42% respectively, showing strong development momentum.

In vitro diagnostic reagents: Export values fluctuated significantly; they recorded a sharp year-on-year decline in 2023 due to reduced demand in the post-pandemic era, with the proportion stabilizing between 4.5% and 5.2% after 2023.

Other devices: Export values generally aligned with the broader market, usually higher in the second half than in the first half. The proportion remained stable between 11% and 13.5%, but showed a slight year-on-year decline in the first half of 2025, with growth drivers to be strengthened.

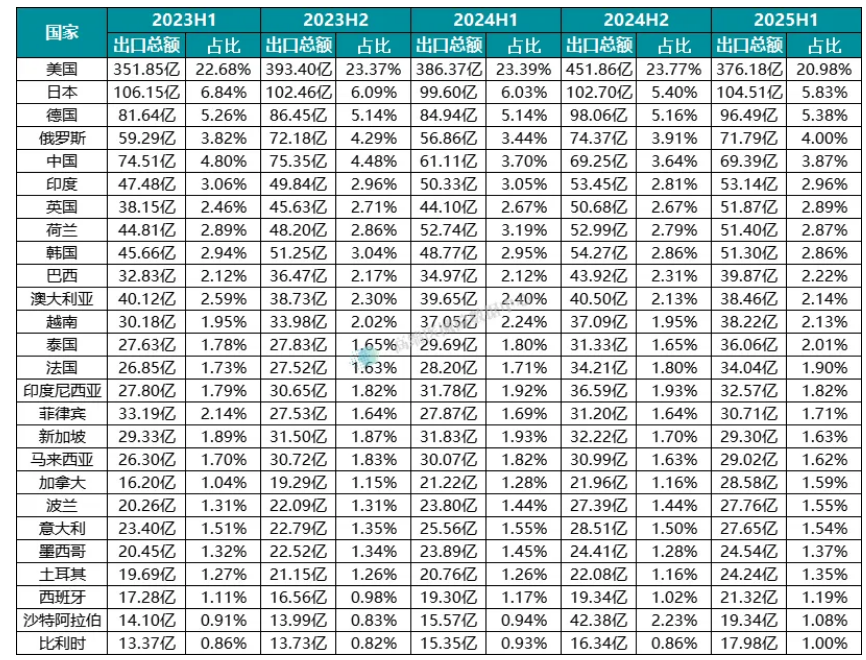

Top three countries by export value

In the first half of 2025, the top three countries for China's medical device exports were the United States (RMB 37.618 billion, 20.98%), Japan (RMB 10.451 billion, 5.83%), and Germany (RMB 9.649 billion, 5.38%). Among these, exports to the United States declined 2.64% year-on-year, which is conjectured to be directly related to the China-U.S. tariff dispute.

Countries with notable increases and decreases

Leading in growth: Exports to Canada, Russia, and Saudi Arabia recorded the fastest year-on-year growth, with growth reaching 34.66% in Canada, 26.26% in Russia, and 24.19% in Saudi Arabia, reflecting the potential of emerging markets.

Significant declines: Exports to Singapore recorded the largest year-on-year decline at 7.94%, followed by Malaysia and Australia with declines of 3.49% and 3.01% respectively.

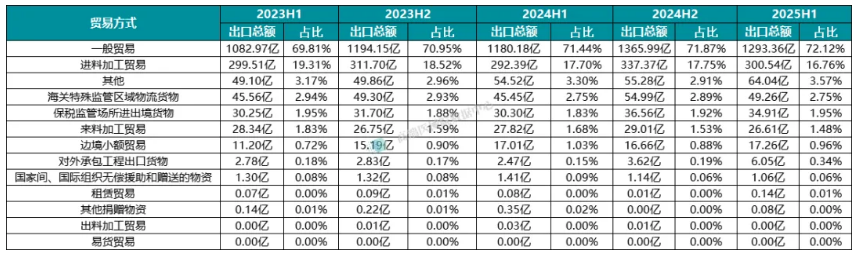

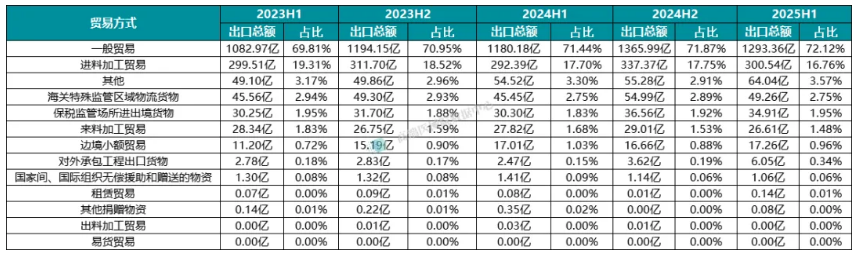

Trade modes:

Chart 8: Export values and proportions by trade mode for Chinese-developed medical devices from customs data over the past three years

General trade: The dominant mode, with exports of RMB 129.336 billion through this mode in the first half of 2025, accounting for 72.12%. The proportion has continued to increase slightly over the past three years, reflecting the autonomy and competitiveness of China's medical device exports.

Processing trade with imported materials: A secondary mode, accounting for 16.76% in the first half of 2025. The model of "importing raw materials - processing domestically - exporting finished products" reflects China's production advantages in the global industrial chain.

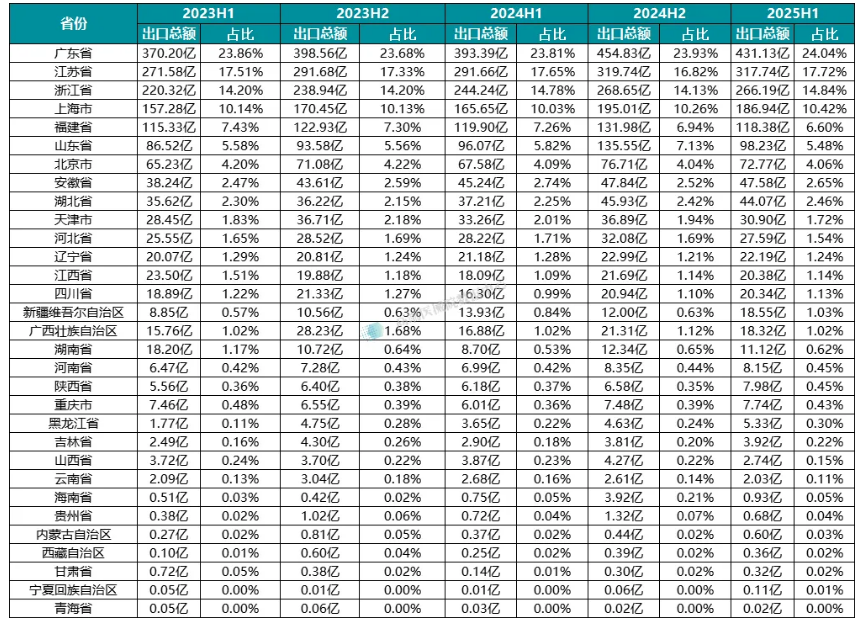

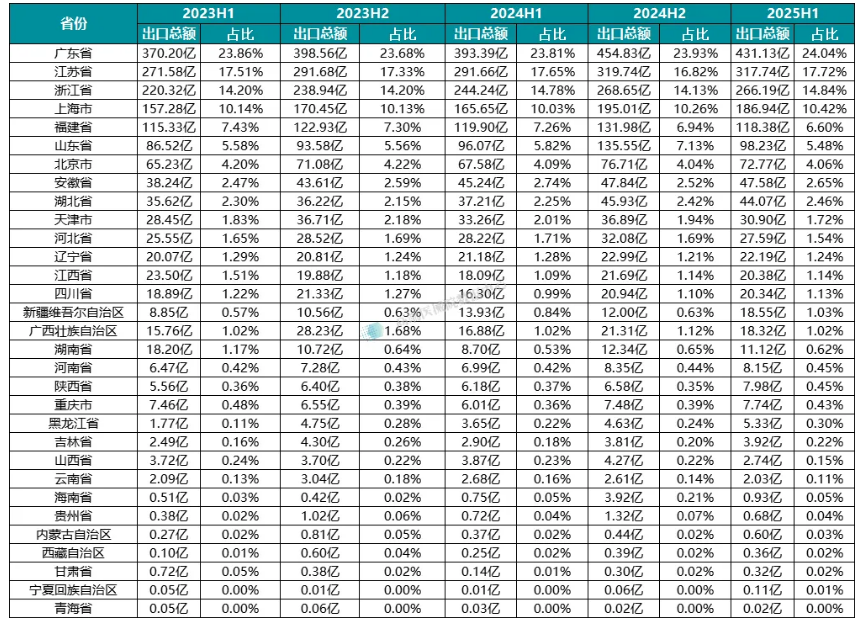

Provincial export landscape:

Chart 9: Export value and proportion by province for national medical device exports over the past three years

Chart 10: Year-on-year change in export value by province for national medical device exports over the past three years

Top three provinces: Guangdong (RMB 43.113 billion, 24.04%), Jiangsu (RMB 31.774 billion, 17.72%), and Zhejiang (RMB 26.619 billion, 14.84%). The proportions of these three provinces have remained stable, with year-on-year growth consistently between 8% and 10%, showing steady performance.

Provinces with notable increases and decreases: the Ningxia Hui Autonomous Region (692.48%), Gansu Province (121.14%), and the Inner Mongolia Autonomous Region (60.88%) led in year-on-year growth; Qinghai Province (-39.96%), Shanxi Province (-29.06%), and Yunnan Province (-24.12%) recorded notable declines.

Chart 11: Import data for the same periods over the past three years and gap between imports and exports

Note: Gap between imports and exports = imports - exports

In the first half of 2025, China's total imports of medical devices reached RMB 167.793 billion, and the gap between imports and exports was RMB -11.540 billion (imports less than exports). From the trend perspective, the trade deficit has continued to narrow since 2023, while the trade surplus has gradually expanded, reflecting the continuously improving international recognition of Chinese-developed medical devices. Given the seasonal pattern of stronger exports in the second half, the full-year gap between imports and exports is expected to set a new record.

Performance by product segment:

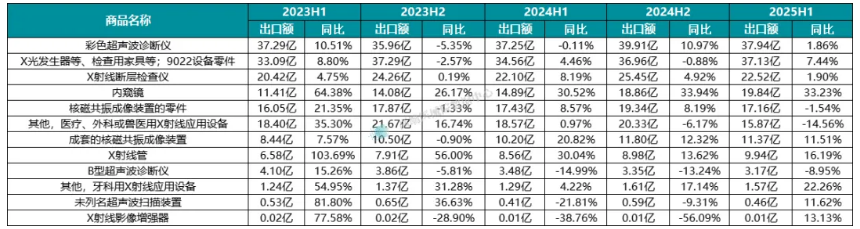

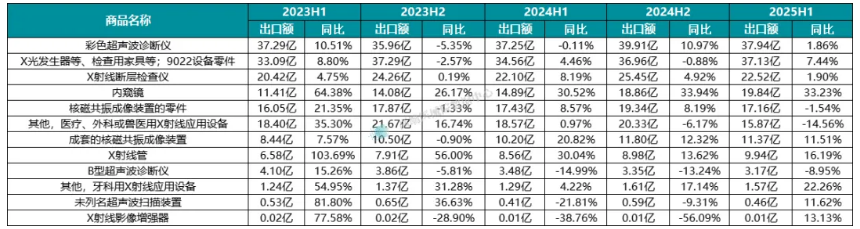

Chart 12: Export values and year-on-year changes for the medical imaging product segment over the past three years

Medical imaging field: Endoscopes stood out, with exports of RMB 1.984 billion in the first half of 2025, up 33.23% year-on-year, making it the fastest-growing product, while "Other medical, surgical, or veterinary X-ray application equipment" fell 14.56% year-on-year, showing a significant decline.

This shows large differences in export performance among different medical imaging products. For example, the export values of endoscopes have continued to grow across all time periods, with the largest growth rate among all subcategories. Represented by endoscopes, such emerging or fast-iterating categories have recorded significant export growth, reflecting the boost to exports from technological upgrades in medical imaging, and that high-value-added and technologically advanced products are more favored in international markets. By contrast, B-mode ultrasound equipment has experienced a continuous year-on-year decline in export value since the second half of 2023, with export value of RMB 317 million in H1 2025, down 8.95% year-on-year.

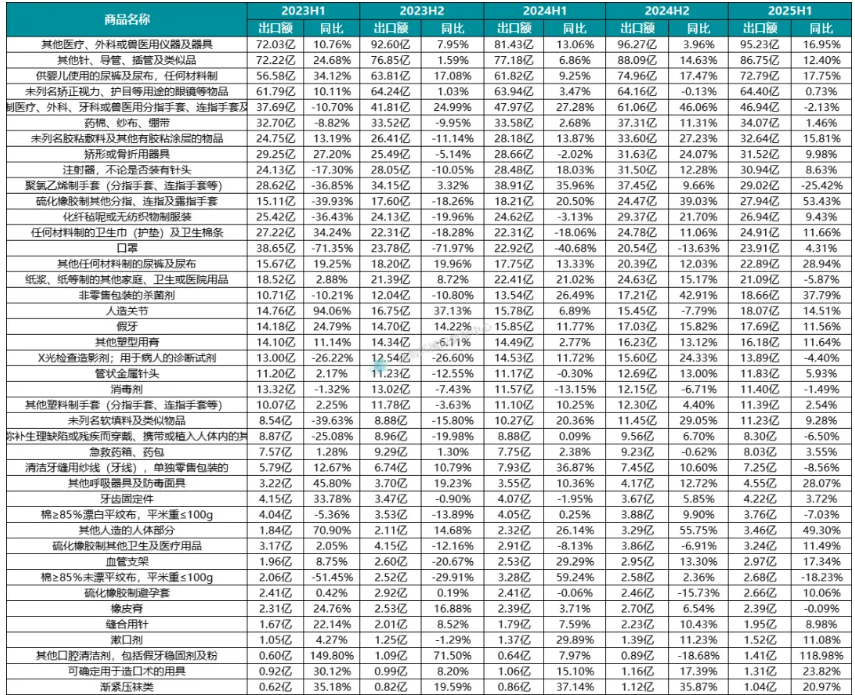

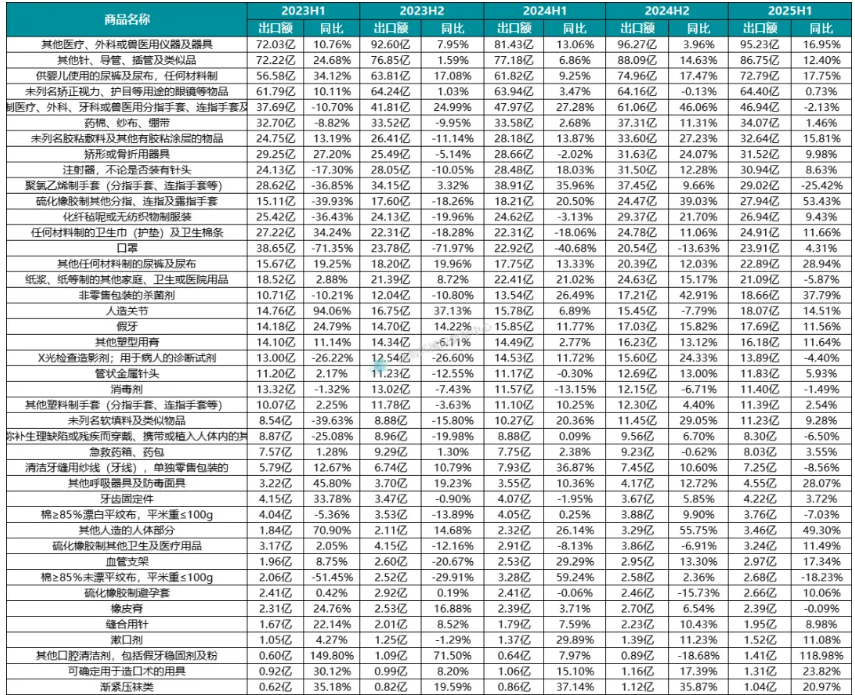

Chart 13: Export values and year-on-year changes for subcategories of medical consumables over the past three years

Note: Products with export values below RMB 100 million are not included in the chart

Medical consumables, as the category with the highest proportion of export value, are still dominated by low-value consumables in exports, with "Other oral cleansers (including denture adhesives and powders)," "Vulcanized rubber gloves/mittens," and "Other artificial body parts" leading in year-on-year growth, reflecting structural opportunities in market segments.

In the first half of 2025, China's medical device exports achieved steady growth amid a complex international environment, exhibiting both the resilience of traditional advantageous categories like medical consumables and the potential of technical products such as IVD instruments and endoscopes. With the arrival of the peak export season in the second half and the rising international recognition of Chinese-developed devices, the full-year export scale is expected to hit a new high. In the future, driven by both technological upgrades and expansion into emerging markets, the structure of China's medical device exports will become more optimized, and global competitiveness is expected to be further enhanced.

Source: Data Center of the Guangdong Institute of Advanced Biomaterials and Medical Devices

Trend in total exports: Continuous recovery, with optimistic outlook for the second half

Chart 1: Total exports and year-on-year changes in customs data for H1 2023 - H1 2025

Looking at the data for the past three years, China's medical device exports have experienced a process from adjustment to recovery. Total exports declined in 2023 compared to 2022, but entered a recovery channel starting in 2024, with the growth in the first half of 2025 continuing this favorable trend. Notably, the second half of the year is typically the peak export season, with historical data showing a growth rate generally higher than in the first half. In light of the counter-trend growth in the first half of 2025, the industry holds positive expectations for further expansion of export scale in the second half.

Category structure: Consumables dominant, and IVD instruments showing impressive growth

Chart 2: Total exports and year-over-year growth by medical device category for H1 2025

Category export landscape: Differentiated export performance across categories

Diagnostic and treatment equipment: Recorded an export value of RMB 49.574 billion, accounting for 27.64%, and ranked second, with consistent year-on-year growth, serving as an important supporting category for exports.

IVD instruments: Became one of the fastest-growing categories, with export value increasing from RMB 9.730 billion in the first half of 2023 to RMB 13.893 billion in the first half of 2025, with the proportion in total exports rising from 6.27% to 7.75%. Notably, in the second half of 2024 and the first half of 2025, year-on-year growth rates reached 39.31% and 33.42% respectively, showing strong development momentum.

In vitro diagnostic reagents: Export values fluctuated significantly; they recorded a sharp year-on-year decline in 2023 due to reduced demand in the post-pandemic era, with the proportion stabilizing between 4.5% and 5.2% after 2023.

Other devices: Export values generally aligned with the broader market, usually higher in the second half than in the first half. The proportion remained stable between 11% and 13.5%, but showed a slight year-on-year decline in the first half of 2025, with growth drivers to be strengthened.

Major export destinations: The United States remaining the top, and significant growth showing in emerging markets

Chart 6: Total exports and proportions by destination country from customs data over the past three years

Chart 7: Year-on-year export value changes by country from customs data over the past three years

Top three countries by export value

In the first half of 2025, the top three countries for China's medical device exports were the United States (RMB 37.618 billion, 20.98%), Japan (RMB 10.451 billion, 5.83%), and Germany (RMB 9.649 billion, 5.38%). Among these, exports to the United States declined 2.64% year-on-year, which is conjectured to be directly related to the China-U.S. tariff dispute.

Countries with notable increases and decreases

Leading in growth: Exports to Canada, Russia, and Saudi Arabia recorded the fastest year-on-year growth, with growth reaching 34.66% in Canada, 26.26% in Russia, and 24.19% in Saudi Arabia, reflecting the potential of emerging markets.

Significant declines: Exports to Singapore recorded the largest year-on-year decline at 7.94%, followed by Malaysia and Australia with declines of 3.49% and 3.01% respectively.

Trade modes and provincial distribution: Stable structure and high regional concentration

Trade modes:

Chart 8: Export values and proportions by trade mode for Chinese-developed medical devices from customs data over the past three years

General trade: The dominant mode, with exports of RMB 129.336 billion through this mode in the first half of 2025, accounting for 72.12%. The proportion has continued to increase slightly over the past three years, reflecting the autonomy and competitiveness of China's medical device exports.

Processing trade with imported materials: A secondary mode, accounting for 16.76% in the first half of 2025. The model of "importing raw materials - processing domestically - exporting finished products" reflects China's production advantages in the global industrial chain.

Provincial export landscape:

Chart 9: Export value and proportion by province for national medical device exports over the past three years

Top three provinces: Guangdong (RMB 43.113 billion, 24.04%), Jiangsu (RMB 31.774 billion, 17.72%), and Zhejiang (RMB 26.619 billion, 14.84%). The proportions of these three provinces have remained stable, with year-on-year growth consistently between 8% and 10%, showing steady performance.

Provinces with notable increases and decreases: the Ningxia Hui Autonomous Region (692.48%), Gansu Province (121.14%), and the Inner Mongolia Autonomous Region (60.88%) led in year-on-year growth; Qinghai Province (-39.96%), Shanxi Province (-29.06%), and Yunnan Province (-24.12%) recorded notable declines.

Gap between imports and exports and product segments: Expanding trade surplus and prominent growth in technical products

Gap between imports and exports: Chart 11: Import data for the same periods over the past three years and gap between imports and exports

In the first half of 2025, China's total imports of medical devices reached RMB 167.793 billion, and the gap between imports and exports was RMB -11.540 billion (imports less than exports). From the trend perspective, the trade deficit has continued to narrow since 2023, while the trade surplus has gradually expanded, reflecting the continuously improving international recognition of Chinese-developed medical devices. Given the seasonal pattern of stronger exports in the second half, the full-year gap between imports and exports is expected to set a new record.

Performance by product segment:

Chart 12: Export values and year-on-year changes for the medical imaging product segment over the past three years

This shows large differences in export performance among different medical imaging products. For example, the export values of endoscopes have continued to grow across all time periods, with the largest growth rate among all subcategories. Represented by endoscopes, such emerging or fast-iterating categories have recorded significant export growth, reflecting the boost to exports from technological upgrades in medical imaging, and that high-value-added and technologically advanced products are more favored in international markets. By contrast, B-mode ultrasound equipment has experienced a continuous year-on-year decline in export value since the second half of 2023, with export value of RMB 317 million in H1 2025, down 8.95% year-on-year.

Chart 13: Export values and year-on-year changes for subcategories of medical consumables over the past three years

Medical consumables, as the category with the highest proportion of export value, are still dominated by low-value consumables in exports, with "Other oral cleansers (including denture adhesives and powders)," "Vulcanized rubber gloves/mittens," and "Other artificial body parts" leading in year-on-year growth, reflecting structural opportunities in market segments.

Summary

In the first half of 2025, China's medical device exports achieved steady growth amid a complex international environment, exhibiting both the resilience of traditional advantageous categories like medical consumables and the potential of technical products such as IVD instruments and endoscopes. With the arrival of the peak export season in the second half and the rising international recognition of Chinese-developed devices, the full-year export scale is expected to hit a new high. In the future, driven by both technological upgrades and expansion into emerging markets, the structure of China's medical device exports will become more optimized, and global competitiveness is expected to be further enhanced.

Source: Data Center of the Guangdong Institute of Advanced Biomaterials and Medical Devices